Scenario analysis to understand climate financial risk in South East Asia

Scenario analysis to understand climate financial risk in South East Asia

There is an increasing awareness that climate change is a material risk to financial stability.

In response, central banks are beginning to design and mandate climate scenario exercises to understand the transition and physical risks to financial institutions and the financial system as a whole.

Climate scenario exercises help financial institutions understand their climate risk. An understanding of the risks can start conversations about adaptation and exploring different ways to adapt to these risks. Understanding and addressing climate financial risks leads to a more resilient financial system

Many financial institutions are doing this type of analysis for the first time and need access to open, transparent, and reliable climate risk data.

Sovereign climate risk scenarios in Thailand

Extreme events can impact sovereign creditworthiness, increasing the cost of debt and stifling economic growth.

As climate change brings more frequent and intense extreme events it is important to consider the implications these events can have on sovereign credit risk. An understanding of the risks can then help inform climate adaptation investments.

In a UK PACT funded project, the University of Oxford and the UK Centre for Greening Finance and Investment are exploring the effects of physical climate risk on Thailand's sovereign credit ratings and the risk reduction benefits of adaptation.

The team used data from the Resilient Planet Data Hub's GRI Risk Viewer and the SE Asia Risk Tool to construct several acute climate risk scenarios to quantify Thailand's sovereign credit risk.

Sources: S&P Global - Storm Alert: Natural Disasters Can Damage Sovereign Creditworthiness

UK PACT

Photo by Miltiadis Fragkidis on UnSplash

The Oxford team has focussed on the two most common disaster events in Thailand:

These events have been selected as they present the most material climate risks to Thailand due to their high frequency of occurrence, as indicated by data from the international disaster database: EM-DAT.

Sources: EM-DAT

1. Floods

2. Typhoons

Figure 1. EM-DAT Recorded Hazard Occurance in Thailand since 1960

For both floods and typhoons, the Oxford team developed three scenarios:

Scenario 1 - Today:

A 500-year return period event in today's climate with current levels of adaptation.

Scenario 2 - Future:

A 500-year return period event in 2050 under a high-emission scenario (RCP 8.5) with current levels of adaptation.

Scenario 3 - Future + Adaptation:

A 500-year return period event in 2050 under a high-emission scenario (RCP 8.5) with additional adaptation (improved building resilience, improved infrastructure resilience, and improved insurance coverage).

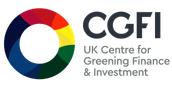

01 Floods

The flood scenario is a 500-year river flood affecting the Chao Phraya River basin in central Thailand, leading to significant destruction of buildings and disruption to roads.

The scenario was constructed using Aqueduct 500-year river flood maps from the GRI Risk Viewer. Direct losses were modelled as GDP impacts, indirect losses due to transport disruption were extracted from the SE Asia Infrastructure Risk tool at the regional level.

We model three flood risk scenarios below.

02 Typhoons

The typhoon scenario is a 500-year return period tropical cyclone hitting eastern Thailand and the capital Bangkok leading to significant direct damages from the destruction of buildings and indirect damages arising from power outages.

The scenario is constructed using synthetic cyclone tracks from the STORM database.

We model three typhoon scenarios below.

Scenario 01: Today

The first typhoon scenario looks at tropical cyclone risk in today's climate (assuming current levels of adaptation).

Direct damage

Maps showing the direct damage for this 500 yr return period event.

Indirect losses

Maps showing the indirect losses for this 500 yr return period event.

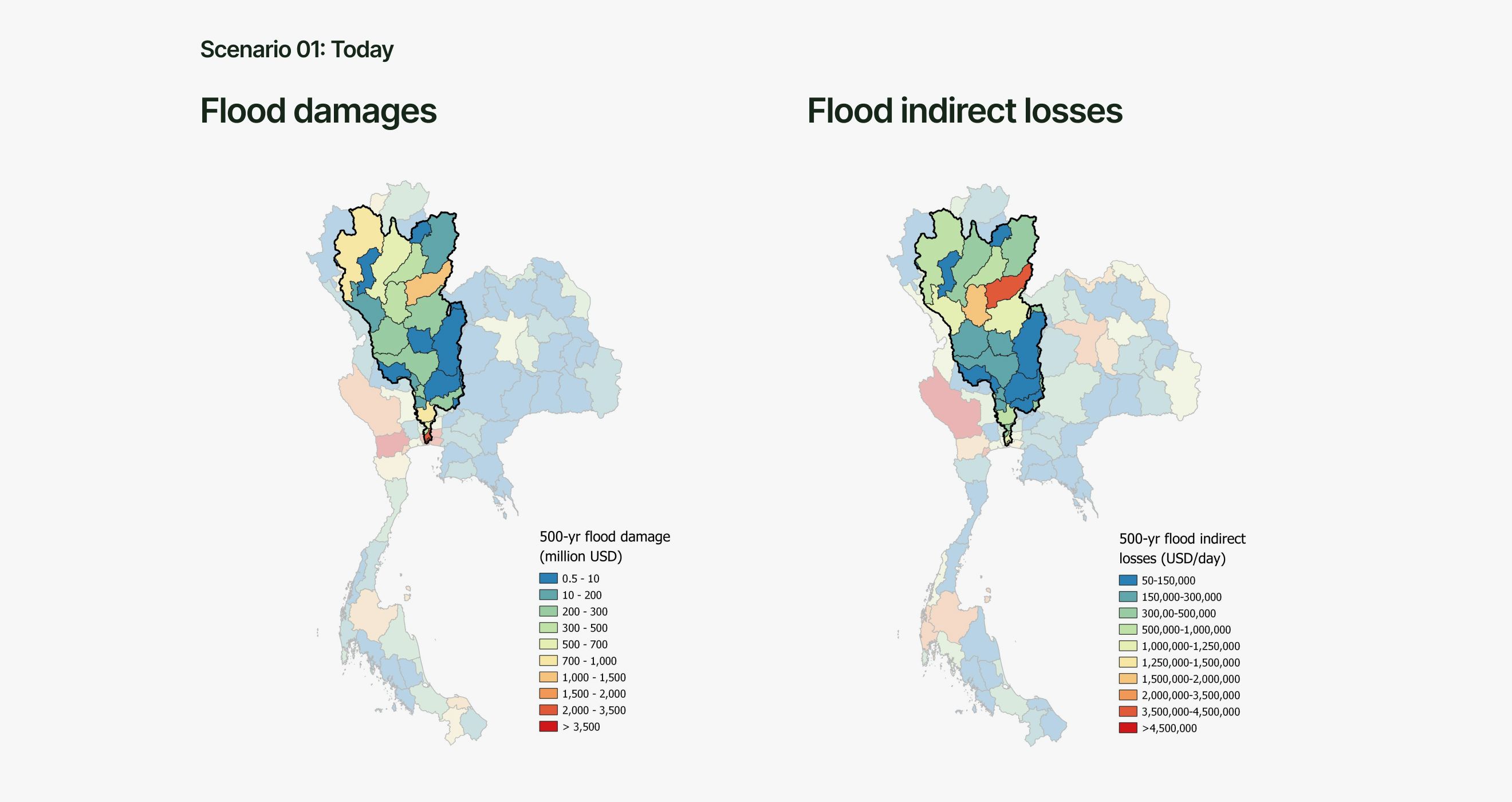

Scenario 02: Future

The second typhoon scenario looks at tropical cyclone risk in 2050 under a high emissions scenario (RCP 8.5) assuming current levels of adaptation.

Future typhoon risk is modelled as an increase in extreme wind intensity. We apply a wind speed change factor for the region from the academic literature to the same tropical cyclone track used in Scenario 01.

Direct damage

Maps showing the direct damage for this 500 yr return period event.

Indirect losses

Maps showing the indirect losses for this 500 yr return period event.

Source: Knutson et. al (2020)

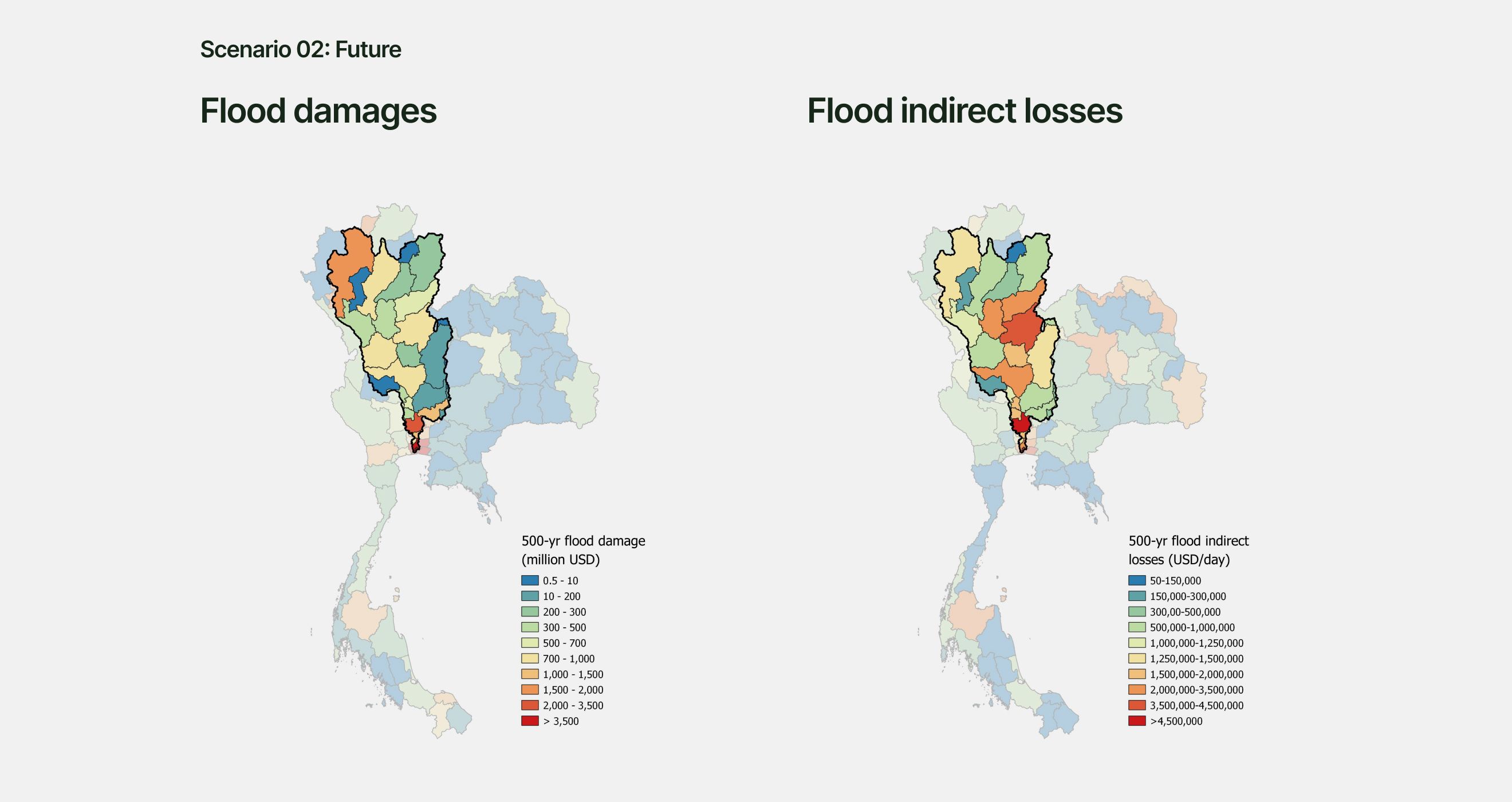

Scenario 03: Future + Adaptation

The third typhoon scenario looks at tropical cyclone risk in 2050 under a high emissions scenario (RCP 8.5) using the same approach as Scenario 02, but models the impact of additional adaptation measures including:

- Improved building design standards,

- A doubling of current disaster insurance coverage,

- Improved energy infrastructure resilience

Direct damage

Maps showing the direct damage for this 500 yr return period event.

Indirect losses

Maps showing the indirect losses for this 500 yr return period event.

Table: Direct and indirect loss estimates from acute disaster events

Impact on sovereign credit ratings

The losses from the acute disaster scenarios were incorporated into a sovereign credit risk model understand the impact these events would have on Thailand's sovereign credit rating, probability of default, and cost of debt.

We emphasize that these results are preliminary and based on a previous academic study of sovereign credit risk and should be interpreted as such.

Sovereign ratings

These events can have a significant financial impact, even in today's climate - extreme flood events or tropical cyclones could lead to single notch downgrades, increasing the cost of debt by hundreds of millions of dollars.

Future scenarios, especially for flooding, paint a worrying picture. Assuming current levels of adaptation, a 500-year flood event in 2050 (in a high emission RCP 8.5 scenario) could lead to a sovereign downgrade of over three notches.

This is significant as it downgrades Thailand's credit rating from investment grade (BBB+) to sub-investment grade (BB-). This can have significant knock-on effects for Thailand's economy: reducing investor confidence and foreign investment, increasing the borrowing costs for domestic banks and corporates, and negatively effecting economic growth.

Investing in adaptation can significantly reduce future sovereign credit risk in Thailand. Improving the resilience of buildings and critical infrastructure, while also increasing the uptake of disaster insurance has been shown in our scenario analysis to significantly reduce future losses from both floods and tropical cyclones. For flooding, investing in adaptation could keep Thailand's credit rating from falling into sub-investment grade if a 500-year flood were to occur in 2050.

Climate risk data from the Resilient Planet Data Hub

Financial institutions are increasingly using climate scenario analysis to understand the risks they face and take measures to adapt to these risks. Data on acute climate risks is critical for institutions carrying out such exercises.

This user story has demonstrated how Resilient Planet Data Hub data enables financial institutions to carry out climate scenario exercises. Climate risk data is available in various formats depending on the needs of the user: from the underlying granular hazard data to pre-computed risk metrics at the sub-national scale.

In providing this data in an open and transparent manner, the Resilient Planet Data Hub helps financial institutions build capabilities to understand and adapt to physical climate risks, leading to a more resilient financial system.

Written with support from